Incorrect Insurance

It is important to ensure all of the correct information is on the claim to prevent delays in payments. Making sure the correct and up to date insurance is obtained can prevent a number of denials and rejections; both of which cause a delay in payment.

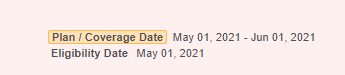

1. Is The Plan Active?

- Verifying eligibility prior to the office visit, especially at the beginning of a new year, will help prevent payment delays and claim denials. If a patient’s insurance plan has terminated, it alerts the office staff that they should ask the patient for their new insurance information.

Example (pulled from Availity.com):

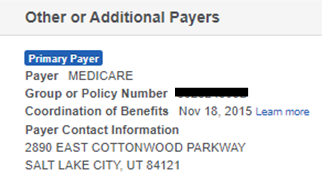

2. Is The Plan Primary?

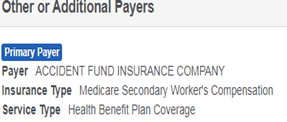

- Checking the patient’s eligibility will also indicate whether or not the plan is primary, secondary or in some cases, tertiary. Insurance web portals will often indicate if there is more than one payer on file. If there is, it alerts the office staff to ask the patient for

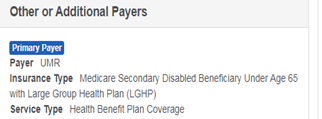

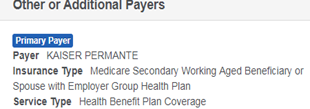

- Sometimes, a member will have Medicare as a secondary payer. In this case, it is mandatory that the Medicare Secondary Payer code be entered on the claim form. This can be found on Availity or the Medicare web portal.

- Common MSP Types:

- Disabled Under 65 Years

- Disabled Under 65 Years

- Common MSP Types:

-

-

- Working Aged or Spouse with Commercial Health Plan

- Working Aged or Spouse with Commercial Health Plan

-

-

-

- No Fault or Auto Accident

- No Fault or Auto Accident

-

-

-

- There can be other Medicare Secondary Payer codes***

For a full list of Medicare Secondary Payer Codes, visit: https://www.cms.gov/outreach-and-education/medicare-learning-network-mln/mlnproducts/downloads/msp_fact_sheet.pdf

- There can be other Medicare Secondary Payer codes***

-

3. Medicare Part B vs. Medicare Advantage Plan

- A patient may provide Medicare Part B insurance information; however, it may not be the correct. When you check Medicare eligibility, it is indicated if the patient has a MCO plan

Medicare Replacement (MCO/HMO) Plans- A member can be covered under a Medicare replacement plan that will take place of traditional Medicare

- Ex: AARP Medicare Complete or BCBS Medicare Advantage

- These plans serve as the patient’s primary Medicare plan

- Traditional Medicare will not be the member’s primary or secondary payer if the member has a Medicare replacement plan

- The plan will usually be listed as Medicare on the insurance card

- Ex: AARP Medicare Complete or BCBS Medicare Advantage

- Ex: AARP Medicare Complete or BCBS Medicare Advantage

About PGM

Physicians Group Management (PGM) is one of the fastest-growing medical billing companies in the United States. For over 35 years, PGM has been providing medical billing and practice management services and software to physicians, healthcare facilities, and laboratories. PGM’s current client base encompasses the full spectrum of medical specialties, including Internal Medicine, Dermatology, Plastic & Reconstructive Surgery, Pathology, EMS & Ambulatory Services, Cardiology, Nephrology, Urology, Pain Management, OB/GYN, Gastroenterology, Independent Laboratory, and many more. PGM’s medical billing and practice management solutions include:

– A full suite of practice management and medical billing solutions each tailored to the specific needs of your practice

– CCHIT-certified electronic medical record software and services

– Streamlined, customized credentialing services for providers of all sizes

– Practice management software that provides advanced financial and practice analysis tools, specifically designed to give enhanced visibility of operations at the click of a button

– Laboratory billing software that offers best-in-class systems to streamline, and manage and track, financial and administrative processes