Physician Medical Billing Services

Medical Billing Customised to Meet the Needs of Physician Practices.

You focus on patients. Let us worry about your medical billing.

You work hard to balance the demands of medicine and business. It’s no easy task ensuring your practice delivers quality patient care, higher productivity and increased cash flow, all while trying to comply with ever-changing regulations and payer guidelines.

PGM can help. Our medical billing service is a hassle-free business solution for physician practices of any size. PGM’s full range of practice management solutions will liberate your staff of tedious physician billing and remittance tasks, helping you to focus on patient care and practice growth. From extending our proprietary online software to your practice to our full-service practice management and medical billing service, PGM will work with you and your team to tailor a solution that best suits the needs of your medical practice.

Our complete practice management and physician billing solution eliminates all charge entry, claim submission, payment posting and follow-up, and much more:

- Claims submission and tracking helping to ensure timely payment

- Remittance advice posting, including EOB scanning and payment verification

- New payer rule development helping to monitor changes and keep payments on track

- Advanced claim scrubbing resulting in clean claims the first time

- Extensive follow-up and appeals process where nothing gets left behind

- No-hassle, web-based software that is easy to use, learn and implement

- Fully customizable reports available 24/7 in real-time, providing in-depth visibility into practice performance and trends

- A global dictionary of insurance package information, ensuring proper payer enrollment

- Periodic account reviews where we examine payer successes and opportunities for improvement

- Learn more about our medical billing services for your specialty.

PGM Revenue Cycle Management

Improved Performance

Practice medicine, not management. Our comprehensive medical billing service is focused on maximizing your collections, getting you paid more and paid faster. Our advanced claim submission reviewer detects medical billing errors prior to entry, dramatically reducing denial rates. We aggressively follow-up and appeal denials and misadjudicated claims, increasing your overall revenue, and offer an enhanced e-delivery solution for patient billing through our partnership with Data Media Associates (DMA) and WorldPay Merchant Services. Specifically, you will improve your collection rates and reimbursement cycle, reduce your accounts receivable, decrease the rate of lost and denied claims and gain improved insight into your practice's financials and performance. With PGM, you will have 100% visibility over your claims, and you will know where your cash is.

By letting PGM manage the task of collecting payments and monitoring reimbursement, you and your staff will have more time to focus on patient needs and practicing medicine.

Personalized Assistance

Our staff is 100% committed to serving you. All of our clients are assigned their own designated account executive, giving you the security and comfort of working with a representative who is uniquely familiar with your practice. From guiding you through the implementation process to frequent performance reviews and updates, our staff is there with you every step of the way.

Transparency

Understanding your practice's financial performance can be challenging. With data buried in patient charts, spreadsheets and antiquated systems, gathering the information necessary to optimize operations and plan for the future is often difficult and time consuming.

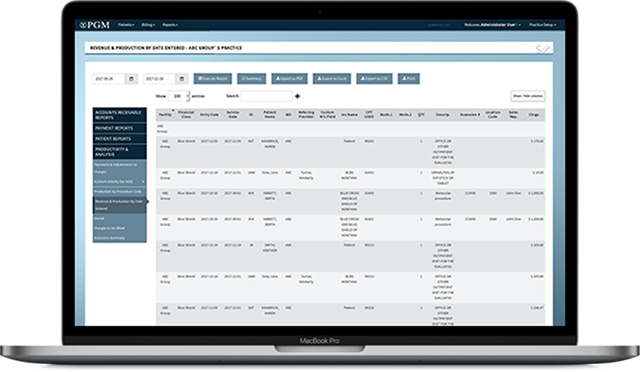

To help meet this challenge, PGM provides you with advanced financial and practice analysis tools, specifically designed to give enhanced visibility of your operations at the click of a button.

Reporting

PGM medical billing reporting is user friendly and grants instant access to data so you can immediately track performance and make qualified decisions. Qualitative assessment becomes easier because you can review everything from which payers reimburse, and at what rates to which business lines are most successful.

See our solutions in action

PGM's Free Medical Billing Software Demo

Please complete the following form and a PGM representative will contact you.

Contact us directly at 877-224-6206 to schedule a live demo.